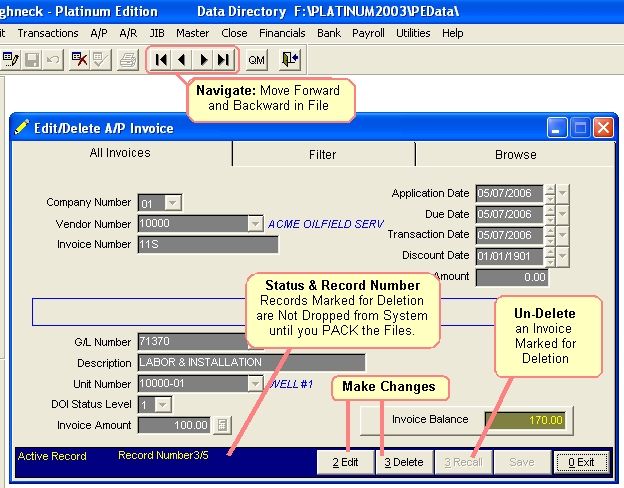

Edit/Delete A/P Invoice, Payments and JE's

The change program allows you to change all entries to an Accounts Payable invoice or payment application.

You can change the invoice number, amount, general ledger number, unit number, status to use for billing Investors and the application or transaction date. You cannot change the Vendor number since values are written to the Vendor file. If the Invoice was entered to the wrong Vendor, you need to delete the Invoice and add an Invoice for the correct Vendor.

Select AP - Invoices - Edit/Delete

The invoice must reside in the APDET.DBF, APREG.DBF and the TRAN.DBF file for you to make changes to an invoice. All files should contain the data you are trying to change. If data is missing from files, you will be flagged which files are missing data. You may have to make adjustments in other files to change this record. Data could be very hard to trace if all records do not exist in the appropriate files.

Changing specific fields of an Accounts Payable invoice will re-write changes to the following data files. Some values are not stored in all data files. You should be familiar with where values are stored if data is missing from files.

FILES UPDATED WHEN ENTERING ACCOUNTS PAYABLE INVOICE OR PAYMENT

APDET DBF - Store invoice record, type 0 or pay record, type 5

APREG DBF - Detail of invoice or payments applied in the Posting Register.

TRAN DBF - Debit and credits to general ledger number 21000 and offset general ledger

number.

VENDOR DBF - Year to date balance - if entered, if paid-year to date 1099 service/rental,

year to date federal tax withhold, state tax withhold amount.

BANK DBF - Amount of payment if posted to cash Account

You may change all fields except the vendor number field. Other fields changed that also exist in other data files will write the change to that file also. Suppose we change the invoice number from 100 to 200. The invoice number will be re-written in the APDET.DBF, APREG.DBF and the TRAN.DBF data files. Other changes will be re-written to the associated data files containing the same information.

If multiple posting were performed for different units or different general ledger numbers for the same invoice, you may select the next button to make changes. Each record changed will be rewritten to the associated files. If you change the amount, the invoice balance will be updated for the correct balance after each amount is changed.

NOTES ON FILTER FOR EDIT/DELETE ACCOUNTS PAYABLE INVOICE OR PAYMENT

Note: In order to get all records of a file, the Filter conditions must be blank, otherwise it will only list records that were contained in the previous filter.

APPLICATION TYPE: You can select which type of transaction you want to view, change or print. (0=invoice, 3=JEC, 4=VCK, 5=Pay, 6=JED, 7=Discount, 8=Federal Withhold, 9=State Withhold)

COMPANY NUMBER: The company number you want to view, change or print.

VENDOR NUMBER: This is the vendor number used for this invoice. You may NOT change the vendor number. If the invoice was entered to the wrong vendor, delete the invoice and pack data files. Enter the invoice to the correct vendor.

INVOICE NUMBER: This is the original invoice number you entered for this vendor. If different units or general ledger numbers were used for the same invoice, the invoice number will be changed for those postings. You may not change the invoice number to or from a credit. The last character of the invoice cannot be changed to 'C'. Associated data files would have to reverse debit and credit entries. You may change an invoice to have the last character 'R' for rental or 'S' for service 1099's amounts.

NOTES ON FIELDS FOR EDIT/DELETE ACCOUNTS PAYABLE INVOICE OR PAYMENT

(Located on the ‘All Invoices’ tab)

VENDOR NUMBER: This is the vendor number used for this invoice. You may NOT change the vendor number. If the invoice was entered to the wrong vendor, delete the invoice and pack data files. Enter the invoice to the correct vendor.

INVOICE NUMBER: This is the original invoice number you entered for this vendor. If different units or general ledger numbers were used for the same invoice, the invoice number will be changed for those posting. You may not change the invoice number to or from a credit. The last character of the invoice cannot be changed to 'C'. Associated data files would have to reverse debit and credit entries. You may change an invoice to have the last character 'R' for rental or 'S' for service for 1099's.

APPLICATION DATE: The date when you entered the invoice in the Accounts Payable programs. The invoice date normally defaults to the current system date. You may have made a mistake when entering this date. It will not effect the Transaction file, as the application date is not stored in the Transaction file. Once the application date is changed, the due date will automatically be changed by the terms assigned to this vendor.

TRANSACTION DATE: This is usually the system default date or the date you entered for this transaction. The transaction date is used for Operating Statement billing. You may want to change the transaction date to prolong billing to Investors until next month. Changing the transaction date will not affect payment of the invoice or the date of the invoice, only the billing for Operating Statements. You can use the calendar button to look up any date for the invoice.

DISCOUNT DATE: The date the discount was applied to the invoice. You can use the calendar button to look up any date for the invoice.

DISCOUNT AMOUNT: The amount of the discount given to the vendor.

GENERAL LEDGER NUMBER: This is the expense general ledger number that is debited. Do not use the Accounts Payable general ledger number. Roughneck automatically posts a credit to Accounts Payable. Investors are billed their share for general ledger numbers in the range of 71001 to 75999 when Operating Statements are printed.

DESCRIPTION: The description entered here will appear on Operating Statements.

UNIT NUMBER: The unit number is processed from the Transaction file to locate the unit name from the Unit/Well file and the owner percentages from the DOI file. If no unit number is entered, the invoice is not billed to Investors.

DOI STATUS LEVEL: Status is stored in the Transaction file and used to locate the correct owner percentages in the DOI file for the transaction. Status of the transaction is used in Operating Statements for expense. If you enter a status of zero, the invoice is not billed to Investors. Changing the status will rewrite to the Transaction file.

INVOICE AMOUNT: This is the amount for this unit. If multiple posting were saved for this invoice to other units, you should select next record. Each posting for this invoice with the same application type will be displayed on the screen for changes. The invoice balance will be reflected after each change of amount. If this is a payment amount and you posted to the cash account, the Bank file will be effected also. Print a new Accounts Payable Inquiry, Accounts Payable Posting Register and Transaction report to verify all changes were made correctly. You can use the “calculator button” to calculate any values without leaving the program or using a 10 key.

NOTES ON DELETING

Records marked for deletion are not dropped until Accounts Payable and Transaction files are Packed. If the application has been marked for deletion previously, you can recall (undelete) it (if the file has not been packed), by performing the delete procedure again. Records that have been marked for deletion do not show up on reports, although the records are still in the file. Records marked for deletion remain in the file until it has been packed. Packing a file removes records marked for deletion from the file, FOREVER!

Naturally, if the debit and credit for the invoice or application has already been moved from the TRANSACTION file to the YTDTRAN file (when you close a period), then the associated debit and credit is not deleted. In this case, you should post a journal entry credit or debit in the general ledger programs, enter a transaction to correct the general ledger balance for 21000 and establish and audit trail for the deletion in the YTDTRAN file.

WRONG VENDOR NUMBER

Question: I entered an Accounts Payable invoice but to the wrong vendor. I have already closed the period, but have not paid the invoice yet. How can I delete the invoice and add it back in to the correct vendor?

Answer: You will need to go into A/P, Invoices, Payments and JEs. Select 6 for JED and specify the Vendor and the Invoice Number, now click the button '1 JED'. Specify the JED amount and put it back to the original GL used. Enter down to 'OK'. Now you must re-add the invoice back in with the EXACT same information (same dates, same unit, same status, amount, etc.) except now you will select the correct Vendor Number. By doing so, you are NOT going to re-bill your investors. After entry is made, you will need to re-close that period again - only this one trasaction will be closed for that period since all others for that period were closed previously - pay attention to your transaction dates. You now have the correct invoice entered and you are free to pay it!

Note on re-closing period: By using the Exact same information (same transaction date) you are putting it back into a Closed Period. Since the period is already closed, if you don't reclose it then this one invoice will be sitting in that period all by it's lonesome self.

Related Topics

How to Void a Check ~ Pack a File

Roughneck Help System 02/15/07 10:30 am Copyright © 2006, Roughneck Systems Inc.